🍔Selling Santa: The Wildest Market Turnaround of the Year

Plus: 2025 Outlook - you don't want to miss this!

The entire market has rebounded sharply in this shortened trading week. At one point, it recovered nearly all of its post-FOMC selloff. In this post we’ll give an update on how the recovery is shaping up and our outlook for 2025 which you definitely don’t want to miss. We promise we’ll keep it brief so you can go back quickly to enjoying your holidays!

The most important lesson (redux)

So far, our call to buy back into SPX last week has been the correct one. We briefly switched to cash, but quickly got back in, and it’s paid off. Some may not like this flip-flopping of views, but when the facts change, we change too.

As market timers, our primary goal is to avoid selloffs. But even more importantly, and what often gets ignored, is participating in the upside rally. This is a key insight we highlighted several months ago in our post "The Most Important Lesson". Now would be timely to give it another read. In fact, we think it’s so important that we’re going to discuss it again today:

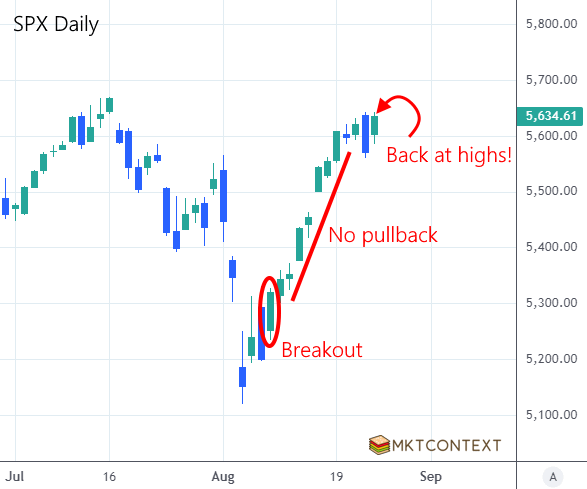

Let’s say you sold your whole portfolio on July 16th at the exact peak of SPX at $5,670. Great job! But oops, you missed buying the bottom. No worries, you’ll wait for a pullback. Hmmmm, there’s no pullback. It’s gotta pull back some time right? Before you know it, the market is at new highs and you’re still in cash. Your perfect top call is now losing you money; you would’ve been better off holding through the drawdown.

-From “The Most Important Lesson”, Aug 25, 2024

The reason is simple: the market has always recovered from selloffs, no matter how deep. Even the most brutal financial crises or prolonged bear markets. We're at all-time highs, which means if you hold through the downturn, you'll eventually make your money back. It may take time, but it will happen. The risk of buying before a drawdown is minimal in the long run.

On the contrary, not all rallies see pullbacks. Most dips don't form a "double bottom". If you're waiting for a better entry point, you risk being locked out of the rally. The opportunity cost of missing the rally is huge and irreversible. And yet most investors worry about the drawdown risk and not the lockout risk. This asymmetry is why many retail investors fail to match the SPX's return, even with a simple buy-and-hold ETF strategy.

The remedy is…

The rest of this article is for paid subscribers. You don’t want to miss this week’s topics:

The most important lesson

Volatility aftershock

Tale of two options indicators

Breadth update - you’d be surprised

Jobs and prices

Outlook for 2025

Start timing the market today!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.